Loan Document Exceptions Monitoring

Loan Document Exceptions Monitoring helps lenders stay ahead of risks by detecting missing or inconsistent information early. By reviewing documents regularly and taking corrective action before issues escalate, lenders can protect their investments, minimize defaults, and ensure a healthier loan portfolio.

Loan Documentation Exceptions Monitoring and Covenant Compliance

What is loan documentation exceptions monitoring and covenant monitoring in banks

Loan documentation exceptions monitoring is the process of identifying and resolving discrepancies or missing information in loan documentation, to ensure that the bank's loan portfolio is in compliance with regulatory requirements and the bank's own policies and procedures.

Covenant monitoring is the process of ensuring that borrowers comply with the terms and conditions of the loan agreements, such as financial covenants (e.g. debt-to-income ratios, liquidity ratios) and other restrictive covenants (e.g. limitations on additional borrowing, limitations on disposing assets). This is to ensure the bank's loan portfolio is in compliance with regulatory requirements and the bank's own policies and procedures. This is to ensure that the borrowers are in a good financial condition and able to repay the loan.

What are the features and benefits of loan documentation exceptions monitoring and covenant monitoring software for banks?

A loan documentation exceptions monitoring and covenant monitoring software in banks can have several features and benefits, including:

-

Automated monitoring: The software can automatically monitor loan documentation and borrower's financial performance for exceptions and flag potential issues for review by bank staff.

-

Error detection: The software can detect errors in loan documentation, such as missing information or inconsistencies, and also detect covenant breaches, which can help banks identify and address potential compliance issues.

-

Risk management: The software can help banks manage the risk associated with loan documentation and covenant compliance by identifying and addressing potential exceptions in a timely manner.

-

Compliance monitoring: The software can help banks monitor compliance with regulations and internal policies related to loan documentation and covenant compliance.

-

Streamlined process: The software can streamline the loan documentation process and covenant monitoring process by automating the monitoring and exception handling process, which can help banks work more efficiently.

-

Historical data tracking: The software can store and track historical data, which can be useful for compliance and reporting purposes.

-

Tracking and reporting: The software can provide real-time tracking and reporting of loan documentation exceptions, covenant breaches, and remediation actions, which can help banks identify trends and improve their processes over time.

-

Improved communication: The software can improve communication and collaboration between different departments and teams within the bank, such as loan origination, underwriting, and compliance, by providing a centralized location for storing and tracking loan documentation and covenant compliance data.

Loan exception management is an important part of managing borrowers financial and reporting documents for loan monitoring. Almost 70% of banks still rely on some combination of spreadsheets, core ticklers, or other manual processes.

Save Time, Same Money, Eliminate Exceptions and Close More Loans.

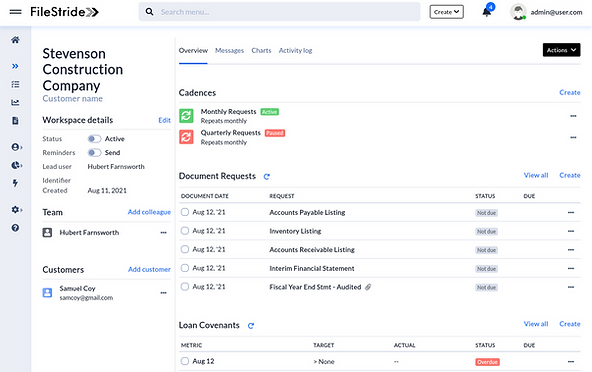

BankStride is a digital banking platform you've been waiting for. BankStride makes it easy for banks to automate loan documents, exceptions tracking, loan reporting and covenant monitoring. No more managing checklists, searching for files in emails, or waiting on updates from other parties. Just create your requests and let BankStride do the work for you.

Many Banks and lending companies depend on non-public client information to provide their

services. Examples include:

-

Automate Document Gathering

-

Checklist For Loan Reporting Requirements

-

Frictionless Customer Experience To Send Documents

-

Create Credit Exceptions & Tickler Tracking

-

Automated Loan Monitoring and Loan Compliance

-

Loan Reporting, Risk & Financial Reporting

Without a dedicated tool, professionals would have to manually manage checklists and calendar

events to keep track of all required information. BankStride automates this work while improving

security and reporting.

Why BankStride platform

BankStride is a web-based software solution for commercial banks and credit unions that works with customers to manage loan agreements and eliminate credit exceptions. FileStride improves credit exception management by reaching beyond the walls of the bank to work directly with customers.

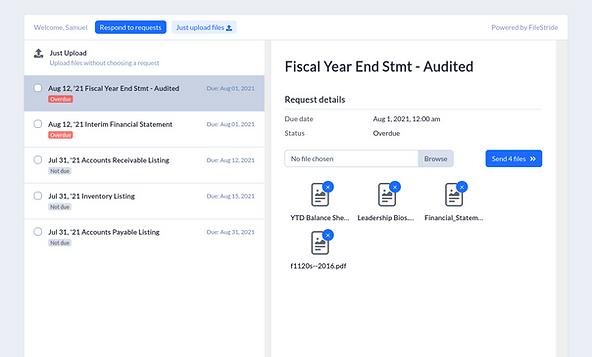

Customers respond to information requests much like paying an online invoice – they clearly see what’s required of them and they act. Customers can respond using a login-less portal or by email – no account or password required.

With BankStride, banking teams can schedule recurring requests for documents like financial statements and tax returns, compare actual and threshold covenant values (e.g. minimum DSCR), and send compliance certificates for signature via DocuSign.

BankStride is like autopay for customer information.

How does this help banks

Banks that pursue superb loan agreement management are faced with handling complex recurring tasks using the basic tools of email, spreadsheets, and calendar ticklers. Banks that let this work fall behind risk delaying their awareness of problematic loans or operating practices, jeopardizing capital and reputation.

A borrower’s risk profile can change significantly over the years that follow a lending event. Managing loan agreement adherence through reporting and internal monitoring is an ongoing and tedious battle for banks.

With BankStride, banks gain high-resolution loan agreement monitoring that saves time and delights customers.

Benefits of Using BankStride for

Covenant Monitoring

Risk Mitigation: By providing real-time alerts and comprehensive monitoring, BankStride helps mitigate the risk of covenant breaches and financial penalties.

Accuracy: Integration with financial systems ensures that the data used for covenant calculations is accurate and up-to-date, reducing the risk of errors.

Efficiency: The automation of data extraction, monitoring, and reporting streamlines the covenant management process, saving time and resources.

Enhanced Compliance: BankStride ensures that all covenant requirements are met, maintaining compliance with loan agreements and fostering strong lender relationships.

How does our bank customer use BankStride

For example, BankStride has proven effective in managing revolving lines of credit. BankStride automatically requests and reminds customers to submit monthly AR and AP listings, inventory analyses, and borrowing base certificates each month.

BankStride reminds the banking team to test various financial ratios. The results of the customer’s actions and the ratio testing all roll up to per-banker and per-office reports that can be run on-demand in seconds.

Our bank customer uses BankStride to schedule and automate the activities required to monitor loan agreements.

BankStride is powerful for bankers

Flexible information management

BankStride supports one-off and recurring information requests with flexible storage layer configuration options.

Healthcare & Life Sciences

Bank leadership can drill down to identify pockets of risk and underperformance, ensuring every team member knows where to focus.

Loan Monitoring

Track financial reporting, covenants, and certificates, and issue compliance certificates for signature via DocuSign.

A Clear Banker's View

See your portal in action.

Easy for bank customers

No usernames and no passwords

Customers receive tokenized links for portal access, and bankers can request information from anyone with an email address.

Upload or email

Easy-to-use customer portals show exactly what is needed, while email-based file ingestion lets customers respond by emailing files.

Timely alerts

Reminders and alerts are aggregated to prevent information overload, can be toggled per user, and feature customizable schedules.

A Clear Customer's View

See your portal in action.

Know what you have, know what you need.

BANKERS STREAMLINE LOAN REPORTING DOCUMENTS

Why BankStride?

We're the digital banking solution you've been waiting for.

We make it easy to automate your loan reporting and covenant monitoring. No more managing checklists, searching for files in emails, or waiting on updates from other parties. Just create your requests and let BankStride do the work for you.

How it works

BankStride combines checklists with cloud storage to help you communicate and monitor your information requests and documents.

All it takes to get started:

-

Request items by creating projects for one-off items or templated lists.

-

Review incoming files from your client and mark items as satisfied or complete.

-

Repeat with automatically recurring requests and reminders.

FEATURES